Friday, April 7, 2017

@AnneMarieTrades Morning Comments for #ES_F, #NQ_F & #CL_F for Apr 7, 2017

CONSIDERATIONS

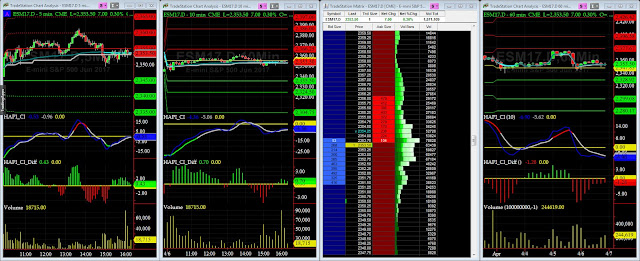

FOR Apr 7, 2017 as emailed to Members at 0813 ET

ES_F– With NFP on deck, just about anything can happen short

term – the question is always after the fact – is there significant weight for

continuation on either level? My suspicion is no based on general

intraday momentum readings at this time. With a good number, we could

also dip as FOMC warnings of an overheated market roiled the space a few days

ago. If you are not experienced (that means novice or bad

experience- evidenced by a chart of your daily balance over time), it is best

to wait for the dust to settle before engaging. The support level near

2349 remains extremely important

·

Buying pressure will likely strengthen above a positive retest

of 2359.75 (but more resistance is ahead nearby)

·

Selling pressure will likely strengthen with a failed retest of

2339

·

Resistance sits near 2359.75 to 2363.5, with 2369.5 and

2376.25 above that

·

Support holds between 2339 and 2334.5, with 2323.5 and

2317.5 below that

***NASDAQ

Futures***

Momentum drifted lower yesterday as the NQ_F presented the

lower high as expected. Overnight, we broke the low but quickly recovered

and is also moving around congestion levels near 5420 . Candles

are likely to hold long wicks today as well, as spikes in either direction

may not hold. We have lower momentum, so rejections of higher levels

could provide excellent shorts for the intraday trader. New support

levels to watch are in the 5370 region. Use caution trading at the edges

today.

·

Buying pressure will likely strengthen with a positive retest of

5446 (use caution as sellers sit up here-wait for a retest)

·

Selling pressure will likely strengthen with a failed retest of

5406

·

Resistance sits near 5456 to 5462.75, with 5477.25 and 5489.5

above that

·

Support holds between 5388.5 and 5380.5, with 5377.5 and 5347.5

below that

***Oil

–WTI Crude***

A big pop in oil took us to the edge of our resistance levels

noted, and indeed, breached before rejecting. If the chart holds and/or

recovers 52.17, we will press further into 53.19. Support holds

below at 51.2, but we could see some big action depending on the weight of

markets. Buyers are battling at a new higher low near 52.17, and a

fade there should give us the retest of 51.7. Momentum is high. Rig

count is out this afternoon.

·

Buying pressure will likely strengthen with a positive retest

of 52.7

·

Selling pressure will strengthen with a failed retest

of 51.2

·

Resistance sits near 52.7 to 53.2, with 53.76 and 54.38 above that.

·

Support holds between 51.2 and 50.77, with 50.47 and

50.06 below that.

We are extremely honored & proud to announce that Anne-Marie Baiynd has joined Team Hamzei Analytics

as Chief OTF Strategist.

Posted by

Hamzei Analytics, LLC

at

12:00 PM

![]()

Thursday, April 6, 2017

Wednesday, April 5, 2017

Tuesday, April 4, 2017

Monday, April 3, 2017

Subscribe to:

Posts (Atom)

Disclaimer and Terms of Service

© Copyright 1998-2023, Hamzei Analytics, LLC. Hamzei Financial Network is published by Hamzei Analytics, LLC, Naples, FL 34112, Admin@HamzeiAnalytics.com (310) 306-1200. The information herein was obtained from sources which Hamzei Analytics, LLC believes are reliable, but we can not and do not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Hamzei Analytics, LLC or its principals may already have invested or may from time to time invest in securities or commodities that are recommended or otherwise covered on this website. Neither Hamzei Analytics, LLC nor its principals intend to disclose the extent of any current holdings or future transactions with respect to any particular security or commodity. You should consider this possibility before investing in any security or commodity based upon statements and information contained in any report, post, comment or recommendation you receive from us. The content on this site is provided as general information only and should not be taken as investment or trading advice. Any action that you take as a result of information, analysis, or conclusion on this site is ultimately your responsibility. Always consult your financial adviser(s) before making any investment or trading decisions.