HOTS Weekly Options Commentary

Peter Stolcers

February 10, 2007

Last week there were only a few economic releases. Productivity rose 3% and unit labor costs were only up 1.7%. Workers are being paid more to produce much more and those statistics could be used to defend concerns over wage inflation. The Senate passed the minimum wage proposal by a landslide last week and the impact of rising hourly wages will be debated in future months. Fed official William Poole stated that economic growth is sustainable and inflation is largely in check. His comments set the stage for Chairman Ben Bernanke who will deliver the Fed's formal economic forecast to Congress when he testifies on Fed Monetary Policy next week(better known as Humphrey-Hawkins Report delivered semi-annually). That testimony will be the economic highlight next week, but there are a number of key reports including: retail sales, industrial production, housing starts and PPI.

Mid-day Friday, sellers came in and drove an otherwise flat market - lower. Earlier in the week, HSBC (the world’s 3rd largest bank) commented that it would take a much larger than expected write-off on non-prime loans. The initial response was contained, but as additional comments came in from other lenders and homebuilders, it was apparent the trough to the housing cycle is far from over. The financials and housing stocks were hit hard. Then, Micron Technologies (MU) warned of lower DRAM and NAND prices and the tech stocks joined the decline. From a technical perspective, the chart shows the long-term strength of the market. We will respect Friday’s price action and acknowledge that a 2%-3% retracement is overdue. However, we will place greater importance on the long-term trend.

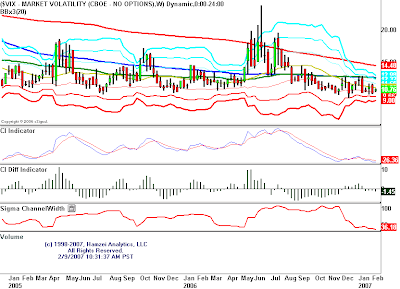

In this week’s HOTS Report, we will position ourselves on the bullish side of the market while keeping our distance. The implied volatilities are still near historic lows and the VIX was only up marginally on Friday. We will sell put credit spreads on two stocks that have relative strength and well-defined support levels. One is a major financial institution that just announced an enormous buy-back and the other is one of the fastest growing gold producers in the world. We will also scale into a call position on a stock that has strong momentum and just broke out. Profits are on the rise as it caters to the rich, generating half of its revenue from Asia. If the market pulls back, we will add to the position. If the market rallies Monday, we’ll be satisfied with what we have.