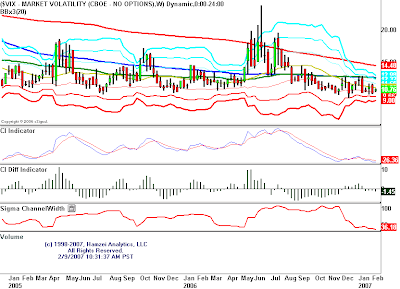

Volatility

Sally Limantour

February 8, 2007

Volatility or the lack of is on everyone’s mind. On CNBC early this morning they played the theme song from Jaws with the title, IS VOLATILITY COMING BACK – then phased out to a commercial. The NYT on Feb 3rd had an article IT’S CALM. LOOK OUT FOR A STORM. “If complacency breeds danger, then we might be sitting on a powder keg heading into 2007,” James Stack, editor of, Invest Tech Market Analyst.

The low reading in volatility which is trading close to record lows set in 1994 is comforting to many. A belief that the evolution of financial products makes the stock market inherently less volatile than it use to be is becoming its own mantra.

“People are very worried about risk,” says Tobias Levkovich, equity strategist at Citigroup Investment Research, and the fact that so many investors are focusing attention on volatility is another reason not to be concerned.

I see the logic in all of this – being concerned, not being concerned, being indifferent about being concerned all over this concept of volatility. My gut feel is this is going to be a volatile year. I have my reasons why and began putting on volatility strategies last week. We shall see…

Bonds

Dr. Plosser tried to crash the party yesterday with talk of higher rates. At the heart of his antinflationary remarks is a fear that labor costs are about to advance. The market remains well bid and shorts established two weeks ago were covered yesterday. Perhaps a light upward bias will take bonds back to 112 00, though I would be a seller there. You have a sector of the trade questioning overall growth prospects ahead and then you have the non-farm productivity up 3.0% annual rate in 4th quarter which was far better than the consensus of 2.0% (non-farm payrolls for all of 2006 rose 2.1%).

Stock Indexes

HSBC has warned that debts will be higher than the consensus due to further deterioration in third-party originated sub-prime mortgages in the US. Disney had impressive earnings and while I think we are building toward a correction you cannot argue with the pretty charts. The mid-cap and small caps are leading the market and that is usually a positive development. The NASDAQ is the only major index that has not set a new high this month. February typically is one of the worst performers, but seasonal tendencies cannot always be trusted nor followed. Trade with caution and perhaps tighten the stops.