Tuesday, November 13, 2012

Monday, November 12, 2012

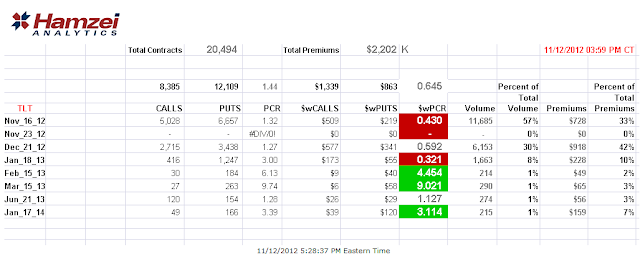

Final $TLT #PutCallRatio for Monday, November 11, 2012

Introducing our brand new product - HFT Bonds with Bonds Strategist, George Cavaligos. Take a look at what we do then jump in for a test drive. Just email us at HFT_Bonds@HamzeiAnalytics.com add TEST DRIVE in subject line. (First and last names are required.) or send us a follow request on Twitter: http://www.Twitter.com/HFT_Bonds

*OFFER EXPIRES NOVEMBER 12th.

Posted by

Hamzei Analytics, LLC

at

5:42 PM

![]()

Daily #Equity #Markets Commentary Nov. 12 By @pnavarro88

Posted by

Hamzei Analytics, LLC

at

5:27 PM

![]()

Friday, November 9, 2012

Final #TLT #PutCallRatio for Friday, November 9, 2012

Introducing our brand new product - HFT Bonds with Bonds Strategist, George Cavaligos. Take a look at what we do then jump in for a test drive. Just email us at HFT_Bonds@HamzeiAnalytics.com add TEST DRIVE in subject line. (First and last names are required.) or send us a follow request on Twitter: http://www.Twitter.com/HFT_Bonds

*OFFER EXPIRES NOVEMBER 12th.

Posted by

Hamzei Analytics, LLC

at

9:20 PM

![]()

Daily #Equity #Markets Commentary Nov. 9 By @pnavarro88

Posted by

Hamzei Analytics, LLC

at

5:29 PM

![]()

Comments on Euro Currency

Attached is a chart of the ECZ2.

The RISK OFF trade

remains in tact as treasuries and the dollar are bid this

morning.

Good news out of china has slowed the Aussie's decline and

makes our short bias in the euro that much more attractive. Price action in the ECZ2 is still negative and we would look to take profit on half of our short at

126.25 (approx 50% retracement of the up trend that began in July).

----------------------------------------------------------------------------------------------------------------------

This free trial is open to all for the rest of 2012.

If you trade any of CME Group listed Currency Futures contracts, you should send us a follow request thru http://www.twitter.com/HFT_Currencies

Posted by

Hamzei Analytics, LLC

at

10:11 AM

![]()

Thursday, November 8, 2012

Final #TLT #PutCallRatio for Thursday, November 8, 2012

Introducing our brand new product - HFT Bonds with Bonds Strategist, George Cavaligos. Take a look at what we do then jump in for a test drive. Just email us at HFT_Bonds@HamzeiAnalytics.com add TEST DRIVE in subject line. (First and last names are required.) or send us a follow request on Twitter: http://www.Twitter.com/HFT_Bonds *OFFER EXPIRES NOVEMBER 12th.

Posted by

Hamzei Analytics, LLC

at

5:09 PM

![]()

Daily #Equity #Markets Commentary Nov. 8 By @pnavarro88

Posted by

Hamzei Analytics, LLC

at

4:57 PM

![]()

Update 2 for Euro Currency by @JimIuorio

Attached is a chart of December Euro Currency (ECZ2).

We maintain our short bias and will do so until we have

settlement above 128.25.

We still believe that fiscal cliff

uncertainty will force the dollar higher and the market may

recycle European headlines that could disproportionately weaken

the Euro. We are not suggesting that there are not real and

new problems in Europe. We are only pointing out the markets

tendency to justify moves with hand picked headlines.

----------------------------------------------------------------------------------------------------------------------

This free trial is open to all for the rest of 2012.

If you trade any of CME Group listed Currency Futures contracts, you should send us a follow request thru http://www.twitter.com/HFT_Currencies

Posted by

Hamzei Analytics, LLC

at

8:59 AM

![]()

Wednesday, November 7, 2012

Stock Market Timing Charts

Timer Chart: Down Volume to Up Volume Ratios are not at capitulation levels but CIs are flat. 1380 is 200-day MA and next key test for SPX. NDX today broke 200-day with AAPL totally unloved.

Timer Chart: Down Volume to Up Volume Ratios are not at capitulation levels but CIs are flat. 1380 is 200-day MA and next key test for SPX. NDX today broke 200-day with AAPL totally unloved.

Wyckoff Chart: As you all recall from our last market timing webinar, our main concern here has been the sell-off in DJ Utils in the last two weeks. And, today we saw DJIA, DJ Trans & RUT punch thru their respective 200-day MAs.

SP1_momo Chart: Our weekly and daily timing models for SPX are still BUY on WEEKLY and BUY on DAILY (as of yesterday close). If 200 bar MA is punched thru (1380), next target becomes 1343. Keep in mind, these levels are adaptive.

Vol of the Vols Chart: Very minor bump in vol indices. Data still does not support any specific scenario yet.

No signal on TRIN Chart.

MAC+ Chart: Our MAC+ [synthetic] indicator was outstanding today. It was the main reason we were done trading for the day before 0900 CT. Just look at the 5-min MAC+ (right hand side chart) avalanche staying within -1 to -2 sigma channels. The 30-min MAC+ also went straight down (center chart).

As we pointed out on Saturday on @HunterKillerSub, next target is 55%. Today we closed at almost 61%.

As we pointed out on Saturday on @HunterKillerSub, next target is 55%. Today we closed at almost 61%.

-----------------------------------------------------

Bottom line: We should continue lower till Down Volume to Up Volume Ratios signal a capitulation.

Posted by

Hamzei Analytics, LLC

at

8:31 PM

![]()

Subscribe to:

Posts (Atom)

Disclaimer and Terms of Service

© Copyright 1998-2023, Hamzei Analytics, LLC. Hamzei Financial Network is published by Hamzei Analytics, LLC, Naples, FL 34112, Admin@HamzeiAnalytics.com (310) 306-1200. The information herein was obtained from sources which Hamzei Analytics, LLC believes are reliable, but we can not and do not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Hamzei Analytics, LLC or its principals may already have invested or may from time to time invest in securities or commodities that are recommended or otherwise covered on this website. Neither Hamzei Analytics, LLC nor its principals intend to disclose the extent of any current holdings or future transactions with respect to any particular security or commodity. You should consider this possibility before investing in any security or commodity based upon statements and information contained in any report, post, comment or recommendation you receive from us. The content on this site is provided as general information only and should not be taken as investment or trading advice. Any action that you take as a result of information, analysis, or conclusion on this site is ultimately your responsibility. Always consult your financial adviser(s) before making any investment or trading decisions.